Sir Michael Cullen’s Tax Working Group report came out yesterday. I was asked by Chris Keall to comment for an article in the New Zealand Herald in which I was positive about the recommendations. The key points are (noting I’m not a tax expert):

- The Capital Gains Tax (CGT) looks fair. If you earn a dollar, why should it matter whether that was from wages or capital gain? Strangely, the report recommends that capital gains on art be exempt, which I don’t understand. I joked to Chris that some of my failed startups could only be described after the fact as works of art.

- The CGT shouldn’t affect professional investors. We already pay income tax on our capital gains as income.

- It’s great that losses can offset gains. This is really important for startup investment, where investors put money into a portfolio of companies with the expectation that some will succeed and some will fail.

- It’s important that capital gains are not taxed until the gains are realised. Otherwise you end up with the nonsense situation where you get taxed on a nominal increase in book value which has a high chance of evaporating.

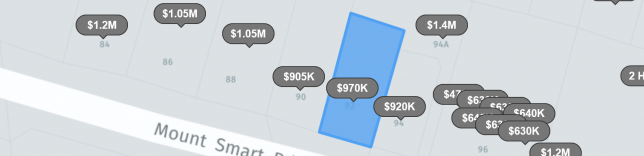

- My hope is that the CGT works toward moving investors out of property speculation and into the productive economy. New Zealand’s fixation on property investment is unhealthy for a variety of reasons. It doesn’t add much to employment, encourages speculation, and drives up real estate prices making home ownership a distant dream for many. We live in a time of unprecedented opportunity as many new technologies are blossoming, and yet the existing tax system actively encourages property speculation.

- Overall, it is good to see the tax burden shifting from the poor to the rich. The minimum threshold for income tax is being raised significantly, which will mean that fewer people on very low incomes will pay any tax at all.

- The devil is in the implementation details. It will be interesting to see which subset of the recommendations the government decides to implement.

National Party leader Simon Bridges says he’ll fight the CGT every step of the way as it amounts to “an assault on the Kiwi way of life”.

This Tax Working Group report is an assault on the Kiwi way of life. I will fight it every step of the way.

— Simon Bridges (@simonjbridges) February 20, 2019

I’ve always taken fairness as being the core Kiwi value. If property speculation is somehow central to Bridges’s “Kiwi way of life”, then it’s time to upgrade our modus vivendi.

Heya Dave.

Thanks for the thoughts. I have been a bit busy with work lately to really delve deeply into the CGT details and debate, but generally I reckon I am in favour of it, mainly for the social equity objectives, though it is also true that other tax/spending policies could address those same equity issues. Wondering how to interpret you comment that “CGT shouldn’t affect professional investors. We already pay income tax on our capital gains as income.” A few issues with that. First, from what I have read, the current CGT is intended to target (in part) gains from investment properties (not owner occupied homes). So is your definition of “professional investors” referring to non-property investors? Is your argument for not taxing “professional investors” based on wanting to somehow encourage some particular type of “professional investment” distinct from property investments? What do you think about exemption for capital gains on owner-occupied home? Also, thinking about whether CGT represents some sort of “double taxation”, since the capital gains being taxed are accruing on assets purchased with net income, seems that is also true for me holding any financial asset like a CD in bank (or any interest earnings). I have to pay tax on interest earnings, even though I already paid tax on the income that was source of savings. Cheers, JD

Thanks for your comments, Jonathan. When I think of professional investors, I don’t think of property investors – I think of people investing in businesses that create useful goods and services, jobs, and ultimately a better society. I only naively realised recently that when most New Zealanders talk about investors, they’re talking about property investors. I’m neutral about exempting owner-occupied homes.

With respect to double taxation, I don’t understand the confusion, if the tax is only being paid on the gain.